Lenders can't afford to miss what matters

Automate over 90% of collateral underwriter’s work

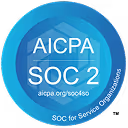

Comprehensive AI-powered review

MIRA goes beyond basic appraisal checks by combining advanced text analysis, image recognition, and detailed audit documentation. It intelligently scans written commentary, detects inconsistencies, and flags potential issues in photos, maps, and sketches—ensuring accuracy and compliance.

Exception-based review made simple

Policy exceptions are displayed in line with every relevant section of data, text, or photos — enabling underwriters to make efficient, precise decisions with all the required information at their fingertips.

Build workflows that work for you

Automated team assignment

Assign incoming loans to the appropriate team based on loan program, SSR score, investor, or other loan attributes.

Intelligent escalations and reviews

Incorporate second-level reviews or automated escalations triggered by specific issues in the report or specific loan attributes.

Connect disparate systems and data sources into one unified experience

Seamless integration with your LOS or OMS

Documents and data move between systems automatically, keeping underwriters in a single, streamlined workflow.

Understand SSR scores and results

SSR scores appear during review and help determine the appropriate rule set, team assignment, and whether an escalation is needed.

Leverage multiple external data sources

Incorporate data from MLS, public record, external influences, and more.

All loans. All reports.

All in one place.

Industry-ready policy engine

Built on over 1 million processed appraisals, MIRA covers every standard form and all major investors out of box

Lender-specific guidelines

Configure rules tailored to your loan programs, investors, or SSR scores. You can vary rules by loan scenario, apply lender-specific overlays, and adjust sensitivity levels in real time to fit your workflow.

Advanced issue detection

Sophisticated models identify and flag potential issues such as bias or subjective language, quality or condition concerns, photo or adjustment errors, comp selection issues, and external factors that could impact loan validity.

Streamline revision requests from start to finish

Auto-generated revision requests

MIRA automates over 90% of the typical collateral underwriter. System generated revisions save time and improve consistency while allowing users to add context as needed.

Automatic evaluation of revised reports

When revised reports are returned, MIRA evaluates whether the identified issues were addressed and checks for any new changes that might bring the report out of compliance.

Comprehensive side-by-side comparisons

If unexpected changes are made to a revised report, MIRA provides a detailed side-by-side comparison to show exactly what has changed.

.avif)

.avif)